Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. You can check this video of mine for more examples of the material quantity variance. Now that we know the standard quantity, we can use the DMQV formula to calculate the variance. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The MQV should be favorable because the standard quantity of the fabric for making 10,000 shirts is 28,000 meters which is less than what was actually used (30,000 meters).

How can businesses improve their direct material price variance?

To find the standard cost, we add the standard labor cost, the standard materials cost, and the standard overhead cost. Variances from this could be favorable if they resulted in a cheaper final product or unfavorable if they cost the company more. Material variance is the difference between the actual cost of direct materials and the expected cost of those materials. Sharing variance reports and findings with relevant departments fosters a collaborative environment where everyone is aware of cost control objectives. For instance, procurement teams can work closely with suppliers to negotiate better prices, while production teams can implement process improvements to reduce material waste. This cross-functional collaboration ensures that all aspects of the business are aligned towards achieving cost efficiency.

Advanced Techniques in Variance Analysis

This year, Band Book made 1,000 cases of books, so the company should have used 28,000 pounds of paper, the total standard quantity (1,000 cases x 28 pounds per case). However, the company purchased 30,000 pounds of paper (the actual quantity), paying $9.90 per case turbotax live (the actual price). The direct materials quantity variance should be investigated and used in a way that does not spoil the motivation of workers and supervisors at work place. Variances occur in most of the manufacturing processes and for almost all cost elements.

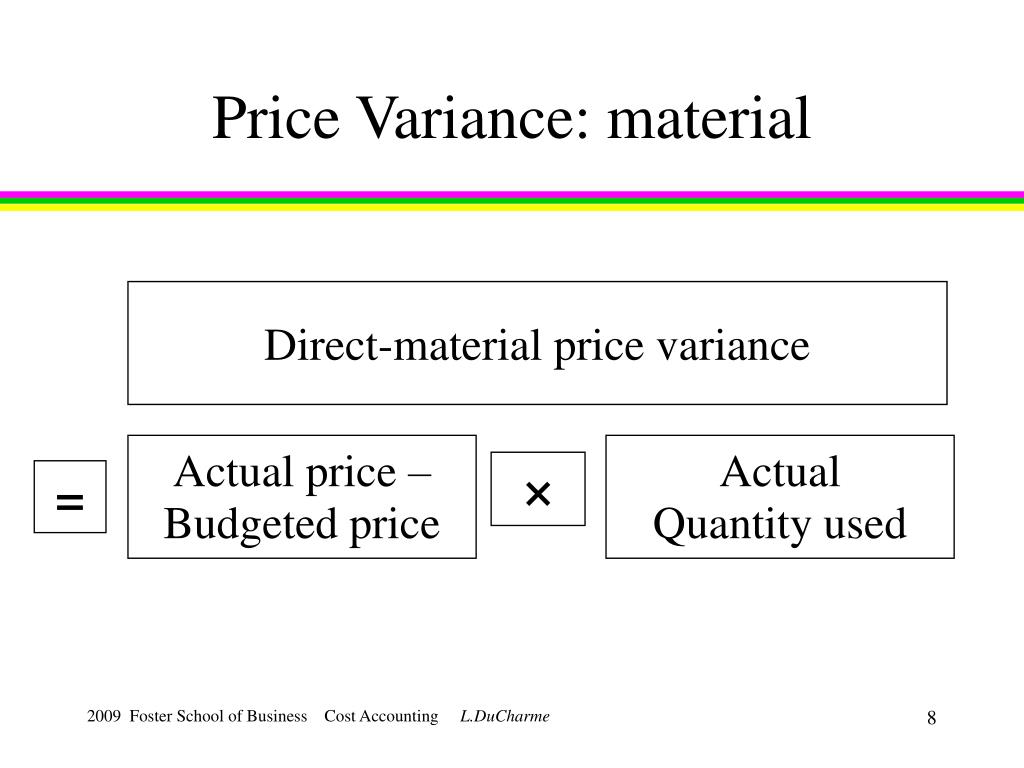

Direct Material Price Variance

The first step in the calculation is to figure out how much stuffing material should be used to manufacture 9000 teddy bears (standard quantity). During a period, the Teddy Bear Company used 15,000 kilograms of stuffing material to produce 9000 teddy bears. Using the materials-related information given below, calculate the material variances for XYZ company for the month of October.

- Additionally the variance is sometimes referred to as the direct materials usage variance or the direct materials efficiency variance.

- On the other hand, if workers use the quantity that is more than the quantity allowed by standards, the variance is known as unfavorable direct materials quantity variance.

- Through this, we saw how it acts both as a guideline for appropriate spending habits for those who may not purchase routinely, as well as a better way to plan for future spending.

- Inefficient production processes, outdated machinery, or inadequate employee training can result in higher material consumption than planned.

- AI algorithms can analyze historical data to predict future material needs more accurately, helping businesses plan better and avoid unexpected variances.

To understand more on this topic, check out our unit price calculator and cost of goods sold calculator. To calculate work-in-progress inventory, add the cost of direct materials to direct labor and manufacturing overhead for the incomplete inventory. Accountants typically use standard costing to estimate the value of direct materials, direct labor and manufacturing overhead in work-in-progress inventory. Direct materials cost is the sum of all direct materials costs incurred during the accounting period. The difference column shows that 200 fewer pounds were used than expected (favorable). It also shows that the actual price per pound was $0.30 higher than standard cost (unfavorable).

What is the definition of a direct materials price variance?

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

A positive value of direct material quantity variance is favorable implying that raw material was efficiently converted to finished goods. Understanding the factors that influence direct material variance is essential for businesses aiming to maintain control over their production costs. Market conditions, geopolitical events, and changes in supply and demand can all cause fluctuations in material costs. For instance, a sudden increase in the price of steel due to international trade policies can lead to an unfavorable material price variance for manufacturers relying on this resource. Companies must stay informed about market trends and consider strategies such as hedging or long-term contracts to mitigate these risks. With our direct material price variance calculator, we aim to help you assess the difference between the actual cost of direct materials and the standard cost.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Finance Strategists has an advertising relationship with some of the companies included on this website.